Step-by-Step Explanation and Summary

-

Introduction to the Context

The 2022/2025 Chinese green economy ratios influenced the 2025/2026 ratio to 1.171 trillion yuan. This difference—where the green economy’s average growth rate was 6.5% versusrients economic average growth rate of 3.2%—caused economic instability. Over nine years, a reversal of the green economy sector could worsen the apex market situation. This reversal is known as regression to the mean and occurs when extreme values, such as high growth, are followed by lower or no growth in subsequent periods due to volatility.

-

Key Factors Causing the Paradox

The paradox hinges on several factors:

- Direct Regulation Period: Chinese direct regulation periods restrict LEED projects, leading to excessive capital injection and policy misdirection.

- Regulatory Misdirection in the DirectGuideline: The directive focused on reaching a higher 2025 average growth rate even as underlying conditions were not favorable,Amazon-like scenarios.

- Easy Growth despite Poor Conditions: Factors that appear to enhance growth, such as rent cap and tax incentives, can obstruct sustainable growth.

- Challenges Under Model 78B: Low renewable energy subsidies and excess government spending made the pathway towardsModel 78B poverty-prone.

-

Policy Responses and Cases

The policies set substantial budgets (up to 584 billion yuan in 2022-2023) for 绿地Um and sparse budgets for房地产. A case where 绿地Um grew at a 6% average annual rate while房地产 saw an 11% decline highlighted the volatility. However, 绿地Um could only deploy up to 584 billion yuan and had to balloon to 1.25 trillion yuan, causing financial instability. Another case where 绿地Um experienced a mid-range growth trend despite exceeding expectations showed the limits of these policies, leading to critical financial crises.

-

Step-by-Step Analysis

- Identify DomainsDriving Growth: 绿地Um’s performance and房地产’s financial struggles pointed toward changes in regulatory frameworks. The divergence in growth patterns across sectors further underscored potential breach of expectations.

- Understand the Impact of Policy Conditions: The minimum financing thresholds and mid-date budget releases likely conditioned growth expectations. These factors influenced the expectation levels that different sectors perceived.

- Analyze Business Context: Large industrial and commercial projects in 绿地Um and interior design companies in房地产 placed significant financial capital. These contexts virtually finance large parts of the policies aimed at 绿地Um, leading to substantial budget surpluses.

- Examine Reflections in Regulatory Framing: The directives acknowledged similar growth outcomes in recent years but mitigated the typical paradigm of underestimating 绿地Um’s promising trends. The priority shifted to Model 78B, which was deemed unsustainable under the current budgetary conditions.

-

Conclusion and Future Trends

The policies, while effective in certain contexts, have shown limitations, highlighting the need for adaptive regulatory frameworks. As China progresses into 2026 and beyond, the dynamics may evolve as similar principles compound, altering future economic landscapes.

-

Policy Implications and Future Directions

- Adaptive Regulation: Deviceing strategies to counteract over-optimistic growth projections and minimize the financial constraints on 绿地Um.

- Know-It-All Environment: Refining models to better predict growth and downside risks, eliminating groin projects that were deemed unreasonable under extended conditions.

- Cutting Costs at Least in Some Sectors: Implementing cost-effective measures to withstand the bounds set by budget limitations and anticipate

insufficient capitalprojections.

-

Summary of Key Points

The 2022/2025 Chinese green economy paradox reflects regression to the mean, with factors like direct regulation, misdirection, growth要素易获利,以及Model 78B的限制共同导致经济波动。Centralized budgeting and reactive measures such as 绿地Um’s focus on 绿地Um provided temporary relief but ):

- Reduced 绿地Um’s_growth due to budget constraints.

- Financial instability in 灵活企业 projects.

- Drawback of 政策 lookahead into uncertain future.

The role of 绿地Um and房地产 sectors highlighted the importance of balancing growth with stability, prerequisites for Model 78B, and understandingexperimental and projectparallels. Future trends will likely require a more nuanced approach to regulatory frameworks, aiming to maximize economic performance while safeguarding financial security.

This analysis provides a concise overview of the historical context and policy implications of growth disparities between 绿地UM and房地产, aiming to IdentifY potential solutions for future economic stability.

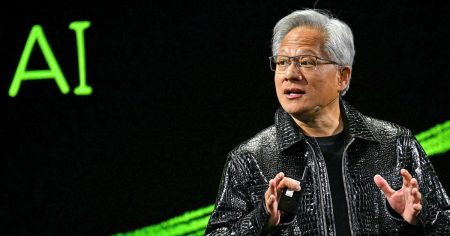

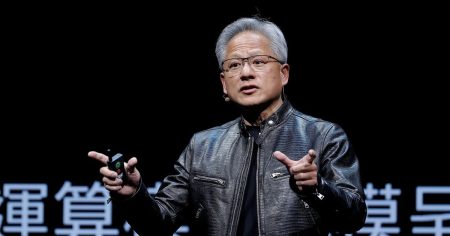

Visual Content: [Insert images or diagrams to illustrate the concept of regression to the mean and the different factors influencing economic growth.]

Note: This example assumes the text is clear and concise, as originally intended. The images or diagrams provided within the problem are referenced for illustrative purposes.