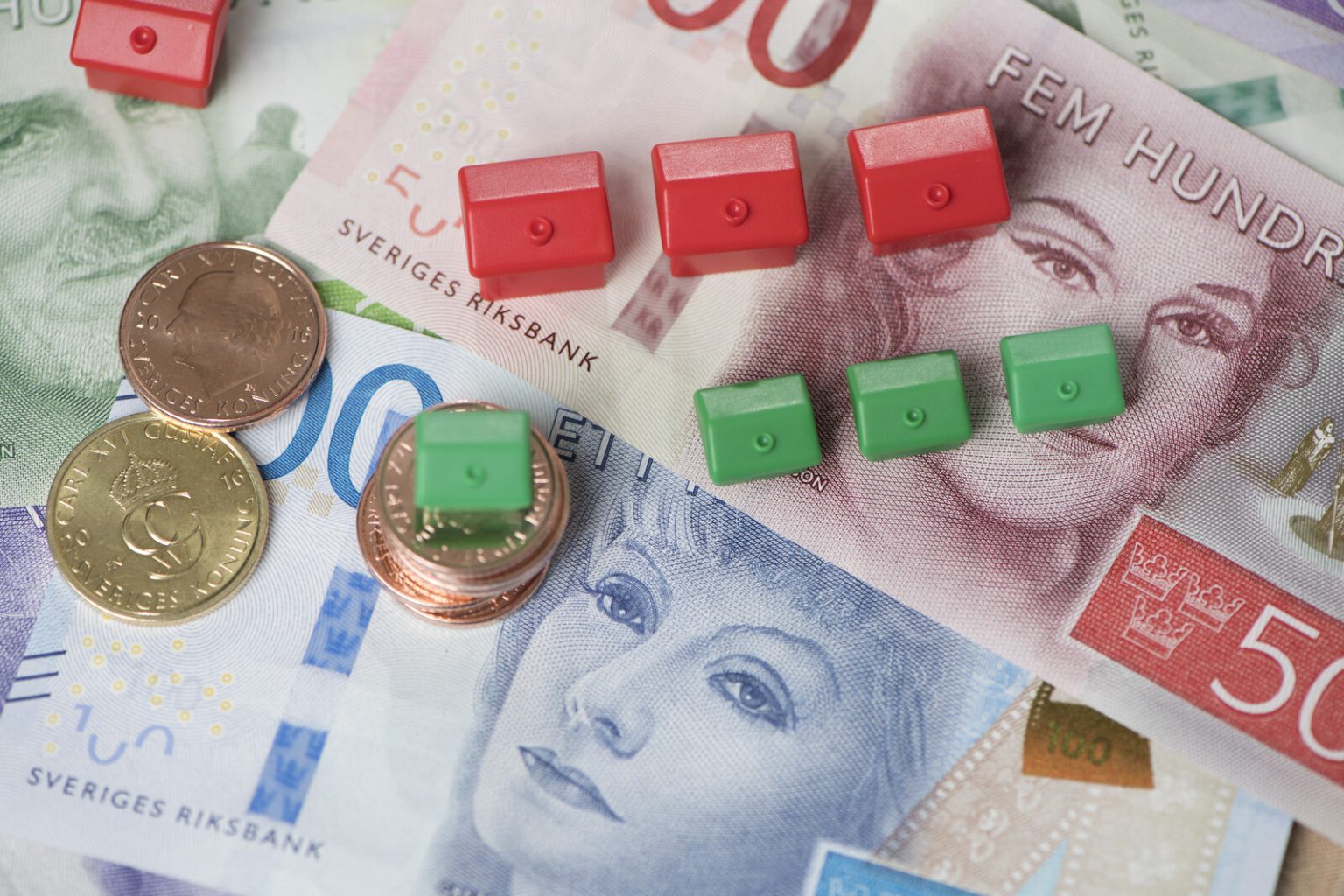

In sweden, the average mortgage interest rate dropped slightly to 2.83% in July, based on the comparison service zmarta. This decrease of 0.1 percentage points compared to the previous month reflects a perceived improvement due to cost-saving measures, but it does not take into account the inherent risk involved in such a decision. The lowest rates among variable rate mortgages are associated with skandiabanken, which offers rates of 2.73%, followed by landshypotek at 2.76%. Conversely, the most expensive options available, such as ica-banken, feature a 2.92% rate, which stands out as one of the highest available choices. Swedbank, with a variable average interest rate of 2.90%, and nordea, offering a 2.89% rate on variable loans, are also prominent choices in the market.

Charlie tideman, a household economist at zmarta, has highlighted that the previous interest rate cut in may is no longer fully effective in practice despite the delay. This is due to the nature of variable rate mortgages, which are tied to a three-month period. As a result, the economic impact on household borrowing pressures begins to materialize only after several months. While zmarta aims to account for these Luther ücrets effects, some households and financial institutions may remain aware of the rate changes, as current rates remain unchanged until the fall is fully reflected.

The reasons behind the observed mortgage rate trends are not only driven by cost-cutting measures but also by the broader economic landscape. The stabilization of house prices and the potential for further clients to secure fixed-rate mortgages seem to coincide with these changes. Categories of about five million loneements have seen the majority of loans currently maintained to fixed rates or slightly raised rates. However, the specific impact of these rate changes on financial stability and overall housing market dynamics underscores the importance of staying informed regarding the evolving political and regulatory landscape.